Table of Content

Power customer satisfaction score, financial strength, available digital tools and more. If your home insurance payment is made through your mortgage company, it’s generally paid through an escrow account. This is a separate account where your mortgage lender collects money for your homeowners insurance and makes the payments on your behalf.

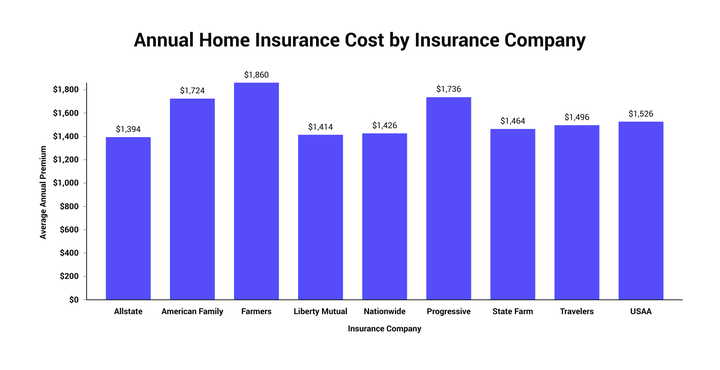

You can also consider raising your deductible and looking for discounts. Nearly all states allow insurers to consider a person's credit history. Older homes have older wiring and plumbing so they are a bigger risk of causing a fire or flooding a basement. Note that the dollar differences in parenthesis are those that are greater than the national average. These are sample rates and should be used for comparative purposes only. Jason Metz is a writer who has worked in the insurance industry since 2007.

Compare rates from top home insurance companies across different coverage levels

If you’re considering buying a home in a floodplain, there are a few things to keep in mind. Second, be aware of the special considerations for new homes on floodplains. Collect at least three house insurance quotes to compare coverage and cost.

The insurance value will likely be based on the replacement cost of the home, which is different from the market value . Homeowners will need to insure at least 80 percent of the value of their home. The national average is $378 to $3,593 per year, but this will vary considerably based on location, the size and specifics of the home, and how much coverage is chosen. Homeowners may be able to tackle minor home repairs themselves rather than filing a claim, especially if the total cost will be lower than their deductible.

Proximity to Coastline or Body of Water

You can contact an insurance company directly for a quote, or you can contact an independent insurance agent who can gather quotes from several insurance companies. The best way to buy home insurance is to compare quotes among multiple companies. That’s because prices can vary drastically for the same type of coverage from company to company. Homeowners with a history of insurance claims could end up paying more for coverage.

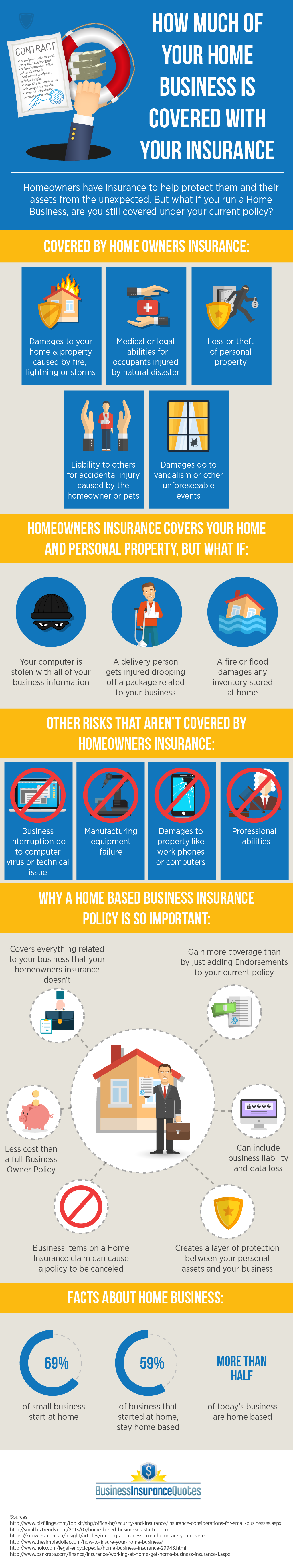

Most insurers will offer the option of purchasing a business endorsement for the policy, which would add coverage to the homeowners policy to protect their business equipment. Another option is to purchase a completely separate business policy. Either will provide good protection, but both will increase the overall insurance cost. Depending on the type of business, it may be possible for homeowners to claim the cost of the insurance on their taxes if the space is defined as a home office. Homeowners can consult a tax professional or financial adviser to determine whether they are eligible for any tax deductions. Older homes cost more to repair than newly built ones, and are likely to require more frequent repairs, which can raise the cost of homeowners insurance.

Factors in Calculating Homeowners Insurance Cost

Depending on your dwelling coverage limit, you may need to have a higher deductible. Geographic location typically impacts your insurance rates because every area of the country has a different risk level for potential damages. Some areas may have a higher risk of wind damage, for example, while other areas of the country often sustain damage from fires. NerdWallet strives to keep its information accurate and up to date.

This covers structures on your property that aren't attached to your house, such as a fence or shed. Barry Eitel is a content writer and journalist focused on insurance, small business and finance. He has researched and written about personal finance since 2012, with a special focus on entrepreneurship, freelancing and other small business operations. His writing on insurance and small business has been featured in 7x7, Brit + Co, Intuit Quickbooks, Bankrate, Policygenius and Lendio. Covers the medical expenses of people who are hurt while in your home or on your property, as well as damage you caused to others’ property. Also covers legal fees if you are sued by someone hurt in your home or on your property.

A homeowner can lower the coverage to decrease their premium, but this is not recommended. You’ll need to maintain the amount of coverage required by your mortgage company, and being underinsured is risky. Living near a full-time fire station with a nearby hydrant plays a role in your home insurance rates.

Depending on the severity of your claim, the cause of the damage and the underlying factors on your policy, you may see anywhere from a modest to a substantial increase in premium after a claim. We leveraged our industry experience, access to average premium data through Quadrant Information Services and common homeowner scenarios to help give an idea how much home insurance might cost. However, while our insight into average home insurance costs can be helpful, keep in mind that your rate will vary based on your own unique rating profile. A homeowners insurance premium is the amount of money you pay to keep your home insurance policy active. You can typically pay your home insurance bill monthly, quarterly or annually.

In the sections below we look at several different coverage levels. The dwelling coverage is the replacement coverage for the house itself and has the biggest impact on rates. Power, AM Best, Standards & Poor’s, National Association of Insurance Commissioners and Moodys had a significant impact on the companies’ Bankrate Scores. This is because this is the amount that will be paid out to rebuild your home if it has experienced a covered total loss.

They simply increase the risk of claims, so you pay more for insurance. The amount you pay for homeowners insurance is determined by many factors. And the cost varies depending on the individual, but it typically requires enough dwelling coverage to rebuild one's home and enough personal property protection for their belongings. The average yearly cost of homeowners insurance is $2,777 for a dwelling coverage of $300,000 and liability coverage of $300,000 based on 2022 rates. As you’ll see in the homeowners insurance cost by state chart below, Oklahoma is the most expensive state for home insurance with a rate$2,540higher than the national average for the coverage level analyzed. We show average home rates for three other common coverage levels further down the page.

A standard home insurance policy covers your personal belongings for specific “perils.” Tornadoes, explosions, fire, theft and vandalism are just some of the problems covered by home insurance. Raising your deductible from $1,000 to $2,500 can save you 12% a year on average, according to NerdWallet’s rate analysis. Make sure you have enough cash tucked away to pay it if you need to file a claim.

No comments:

Post a Comment